If you own stock that has increased in value since you purchased it, gifting it to a Donor Advised Fund or Charitable Checkbook® offers benefits that cash donations simply can’t match.

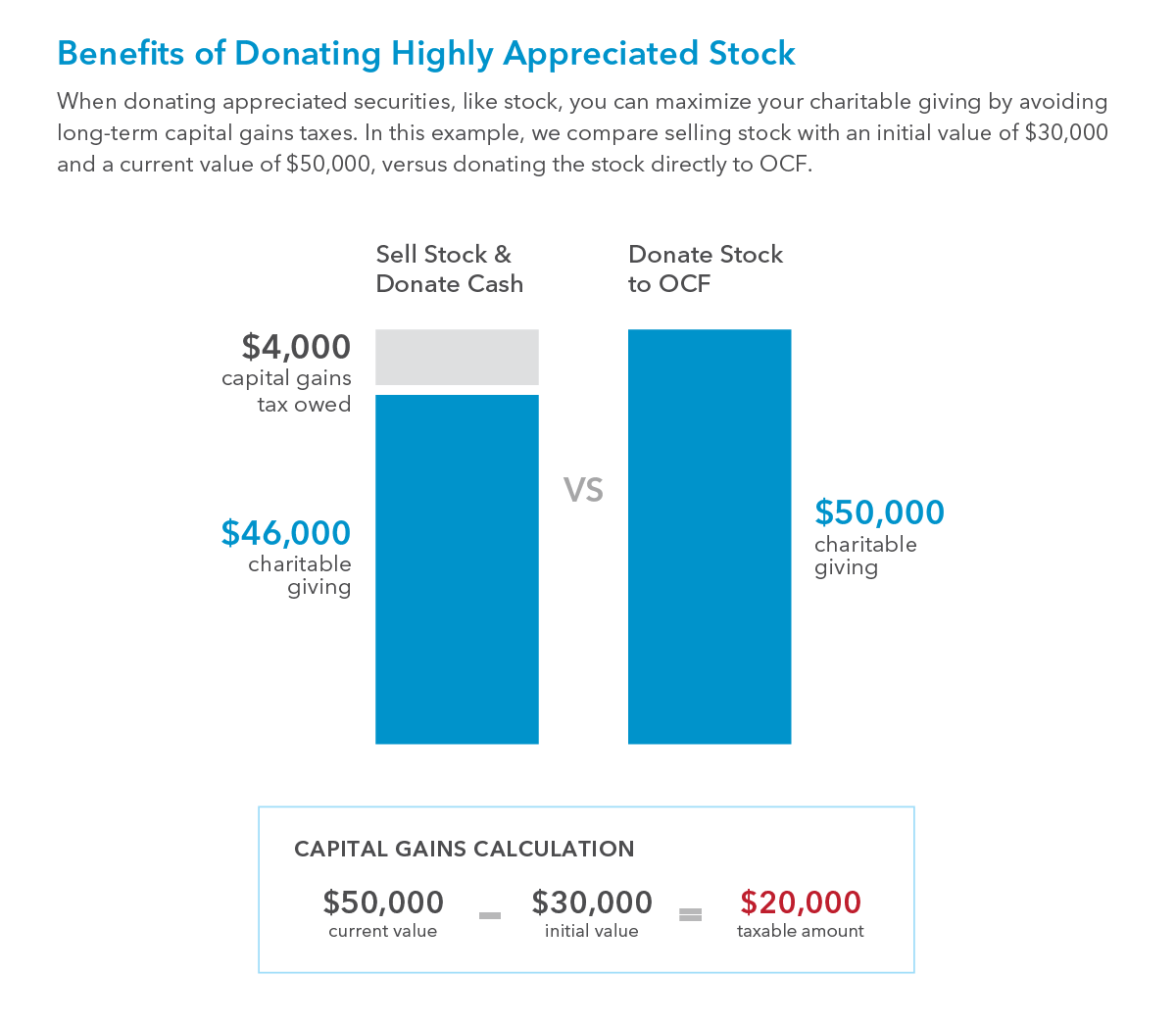

The key advantage of donating appreciated stock lies in capital gains taxes. Normally, if you sell a stock that has grown in value, you’d be subject to capital gains tax — potentially up to 20% — on the difference between the purchase and sale price. However, when you donate the stock directly to a charity (like a fund at the Omaha Community Foundation) you avoid paying those taxes. This means the charity receives the full value of the stock, and you get a deduction for the fair market value of the stock at the time of the donation.

It’s a win-win: you can put more into your giving fund and enjoy a significant tax benefit. If you’re looking to support causes close to your heart while also being financially savvy, this is one of the most impactful ways to give.